I love helping people! One of the biggest challenges I encounter is the suffocating burden of debt. Money buys options. Debt eliminates options. Do you struggle under the mounting pressure of debt…personally and/or in your business? You are not alone. The statistics on debt are troubling:

I love helping people! One of the biggest challenges I encounter is the suffocating burden of debt. Money buys options. Debt eliminates options. Do you struggle under the mounting pressure of debt…personally and/or in your business? You are not alone. The statistics on debt are troubling:

- The average American household has 13 payment cards (credit cards, loan payments and store cards.)

- Americans carry, on average, $8,000 in credit card debt from month to month. If you were to make only the minimum monthly payment on that debt, at 18% interest, it would take 25 years to pay off and cost you more than $24,000 in total.

- 46% of all Americans have less than $10,000 saved for their retirement.

- 96% of all Americans will retire financially dependent on the government, family or charity.

- Only 2% of all homes in America are paid for.

I got these statistics from a website offering debt consolidation services. Unfortunately, most folks misunderstand and misuse these services…and get further into debt. These services can be creditors in disguise.

Here’s the good news. You can get out of debt. It’s EASY to do. IF…you follow this system EXACTLY.

Step One: Get to a KFP – Known Financial Position. Clean up your business Balance Sheet. Create a personal, family Balance Sheet. Have your Bean Team help you, or give me a call. The section called Liabilities is what you owe; it’s your total debt. Once you know, you can start bringing that number down. I know it’s scary. However, knowing is better than not knowing. You can always improve the situation if you are willing to confront it.

Step Two: Start selling at the right price. Include debt reduction dollars in your Budget. Your customers will have to assume some of the burden of your debt in order for you to create dollars to pay it off. Include in your selling price enough salary to contribute to paying off your personal debt and enough profit to pay down your company debt. Much of the debt I see in my consulting work is a result of hardworking owners trying to get by on too little. If you haven’t charged enough in the past, you may have used debt to just get by.

Step Three: Stop buying stuff on credit. On a recent episode of Saturday Night Live they aired a ‘spoof’ TV commercial for a new debt reduction book called, “Quit Buying Stuff You Can’t Pay For.” It was a one page book with one sentence on the page: Quit buying stuff you can’t pay for.

Step Four: Read The Richest Man in Babylon by George Clason. This slim book uses a story to teach the basics about reducing debt and increasing your wealth. This timeless classic was written during the Depression and offers spot-on advice for today.

Step Five: Talk to your creditors. You may be able to work out a better interest rate or payment schedule. Your creditors don’t want you to declare bankruptcy. Talk to the owner or general manager of your supply house. Work with the credit agents for your store cards. Let them know you have a plan and that you are committed to paying off the balance.

Step Six: Start saving. A little bit every month adds up. Start with whatever you will commit to…$100 is better than nothing.

Step Seven: Systematically pay down debt. This is the easy-hard part. It is easy to do it. The problem is it is easier NOT to do it.

The following is based on the great works of John Cummuta. (Check out www.nightingale.com and Search for John Cummuta.)

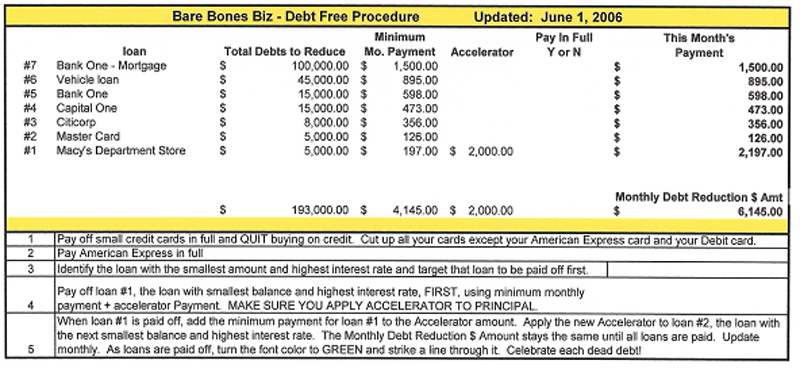

Put together a grid of all your debt. This grid reflects a family’s personal Liabilities…

In this example, $6,145 is the monthly DEBT REDUCTION total. This stays the same every month until all Loans are PAID. (You could do a separate grid for your company debt.)

Note that this debt reduction dollar amount is in addition to the amount that you are systematically putting into savings every month. Once your debt is paid, you could start putting the entire DEBT REDUCTION dollar amount straight into savings every month. How fast would that stack up for retirement?

You can do this. It’s easy. So, why do we fight what we know is right?

We carry around all kinds of emotional and psychological baggage. Maybe Momma always told you what to do and you are still fighting Momma. Maybe you are in denial about what you really owe. Debt management counselor David Huffman claims, “97% of people don’t know what they owe. No one ever taught them ‘Money 101’ of ‘Debt 101.’ That’s why they are broke and getting deeper and deeper into debt.” Whatever. Get over it and get disciplined. Now you know. Put this system in place today. And bring down your DEBT.

Are you ready to make more money? To bring down your debt? This simple form can help you stay focused and disciplined. CLICK HERE TO DOWNLOAD THE DEBT FREE WORKSHEET.